TYPE - 1 - TRADITIONAL MEDICARE (PATIENT ONLY HAVE MEDICARE)

Traditional Medicare functions as the primary insurance for those who rely solely on this coverage option. In this context, it offers coverage of 80% for medical expenses without necessitating preauthorization. The remaining 20% of the financial responsibility falls upon the beneficiary in the absence of additional insurance.

TYPE - 2 - MEDICARE SUPPLEMENT

When Traditional Medicare takes the role of primary insurance, it facilitates healthcare coverage with an 80% reimbursement rate. This arrangement is notable with no pre-authorization requirements, simplifying the process for beneficiaries. In such cases, supplemental coverage, if present, automatically covers the remaining 20% of the expenses. This seamless coordination ensures that beneficiaries can access medical services with ease, knowing that the 20% portion is effectively managed by their supplemental coverage.

TYPE - 3 - MEDICARE + COMMERCIAL PPO

When Traditional Medicare assumes the role of primary insurance, beneficiaries can expect an 80% coverage benefit, and the best part is that no pre-authorization is required. However, the introduction of a PPO (Preferred Provider Organization) as a secondary benefit brings forth certain considerations.

Under this configuration, the rate of reimbursement from the PPO is contingent upon the premium coverage level chosen by the beneficiary. A higher premium corresponds to a more substantial reimbursement. It is imperative to emphasize that to secure this reimbursement and optimize the secondary benefit, pre-authorization is a mandatory prerequisite. This means that prior approval from the PPO insurance is essential before certain medical procedures.

The PPO insurance is structured to cover 20% of the costs, provided that the pre-authorization requirement has been met.

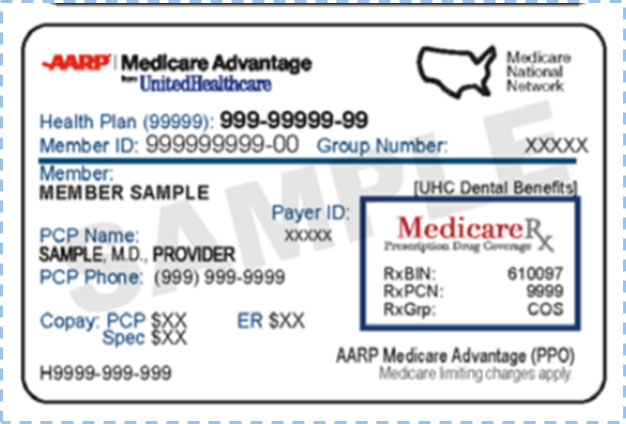

TYPE - 4 - MEDICARE ADVANTAGE PPO

In this type, the Advantage PPO takes on the role of the primary benefit. It is essential to note that Medicare serves as the secondary benefit only if the remaining Advantage Plan does not provide coverage.

Under the primary covered benefit, it is imperative to understand that pre-authorization is a mandatory requirement for most medical procedures. This prerequisite ensures that procedures are approved and covered in accordance with the terms of the plan, contributing to a streamlined and organized healthcare process.

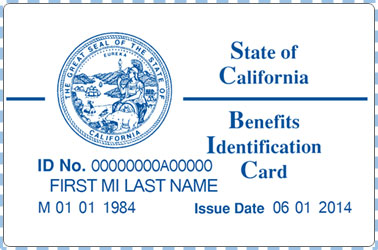

TYPE - 5 - MEDICARE - MEDICAID/MEDI-CAL

In cases where Medicare serves as the primary insurance, it guarantees a coverage rate of 80% for eligible medical expenses.

For individuals falling within the category of low income and benefiting from Medi-Cal/Medicaid, it's important to acknowledge that they are legally waived from bearing the remaining 20% of the medical costs. This exemption is a result of the financial assistance provided by Medi-Cal/Medicaid, ensuring that those with limited financial income are not burdened with additional healthcare expenses.

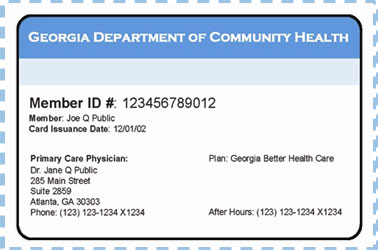

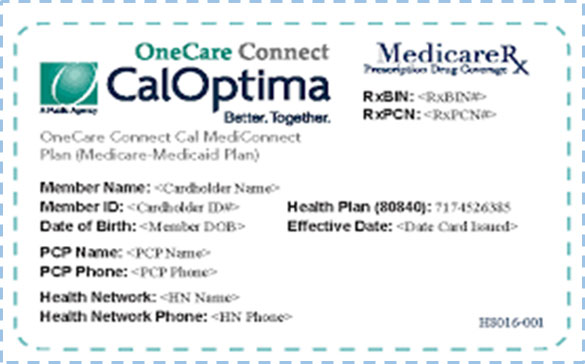

TYPE - 6 - MEDICARE - MEDICAID/MEDI-CAL & HMO

Benefits from Medicare, Medicaid, and Medi-Cal are extended to Health Maintenance Organizations (HMOs) as part of the healthcare coverage framework.

It is important to note that healthcare providers cannot submit bills directly to Medicare.

Note: The patient can cancel the HMO anytime to get back to coverage Type 5 (Active on the 1st of Next Month)

TYPE - 7 - MEDICARE ADVANTAGE HMO

Benefits from Medicare, Medicaid, and Medi-Cal are extended to Health Maintenance Organizations (HMOs) as part of the healthcare coverage framework.

It is important to note that healthcare providers cannot submit bills directly to Medicare. Instead, the billing process and reimbursement mechanisms are typically administered through the HMOs or other designated channels.

Benefits of Medicare Types Summarized

| Medicare Types | Summary |

|---|---|

| Type 1, 2, 3 & 5 | Primary, no pre-authorization is required for the treatment. |

| Type 3 | Although this Medicare type does not require pre-authorization, PPOs demand it in order to guarantee 20% of secondary insurance payment. |

| Type 4 | Medicare Advantage PPO is the primary payer, then pre-authorization for treatment is necessary. |

| Type 6 | Benefits from Medicare, Medicaid, and Medi-Cal are extended to HMOs.Healthcare providers cannot submit bills directly to Medicare. Note that the patient can cancel the HMO anytime to get back to coverage Type 5 (Active on the 1st of Next Month) |

| Type 7 | Benefits from Medicare, Medicaid, and Medi-Cal are extended to HMOs. Healthcare providers cannot submit bills directly to Medicare. The patient can cancel the HMO anytime to get back to coverage Type 5 (Active on the 1st of Next Month) |

Open Enrollment Period - What you need to know?

What is the Open Enrollment Period for Switching to Supplement Plans?

Open enrollment is a time period during which a person can enroll in a range of Medicare coverage options without facing penalty fees, medical underwriting, coverage denial, and more. Each Medicare plan has its own open enrollment period during which an individual can easily add a plan to their existing coverage or switch plans.

When Is Open Enrollment for Medicare Supplement Plans?

You can shift health plans only at certain times during the year. You can enroll, switch, or drop a Medicare health plan between October 15 to December 7 (active on January 1 of next year).

Front Office Focus: Key Areas of Attention

When it comes to running a smooth and efficient medical practice, paying attention to the front office operations is crucial. After all, the front office is the first point of contact for patients and can set the tone for their entire experience.

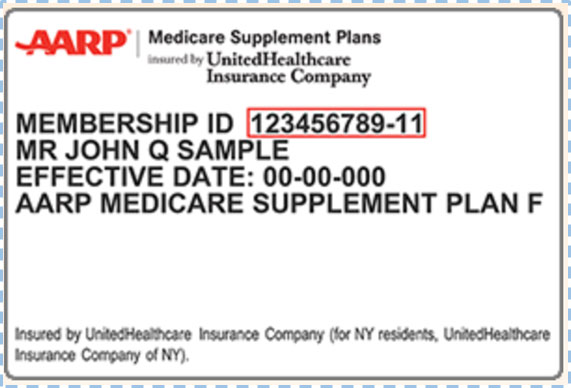

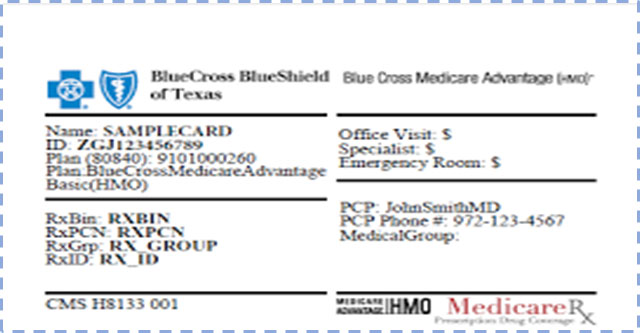

One of the front office's key tasks is to make sure that all relevant patient information is collected appropriately. When a patient arrives at the clinic, the first step is for the front office to collect the patient's complete ID cards, which must then be sent to the billing team for a benefits check.

While checking eligibility and benefits, the billing staff must determine whether Part B is Active as per the patient plan; if so, they can proceed; in the case that Part B is inactive, they won't proceed further. They will notify the front office with the patient benefits report. The front office uses the report to proceed further with the patient.

Additionally, if the patient has an HMO plan, billing staffs don't have to create a visit for them and can send them their benefit reports, however if they have a PPO plan, they can submit their claims with pre-authorization.

The following are important benefits sheet items that the front office should review:

- Deductibles (Family & Individual)

- Out of Pocket Expenses (Family & Individual)

- Co-Insurances (PCP & Specialist)

- Co-Pays (PCP & Specialist)

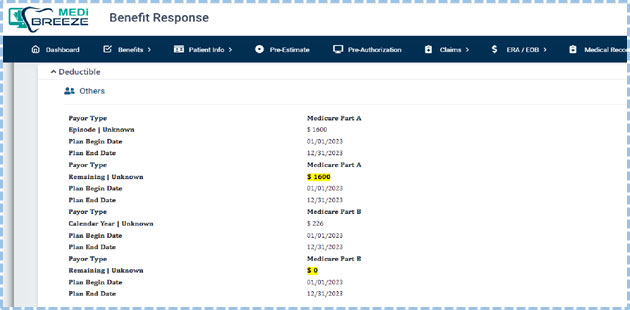

Deductibles (Family & Individual)

The front office needs to check the below screen for the correct deductible information for both Medicare Part A and B (Met and Remaining).

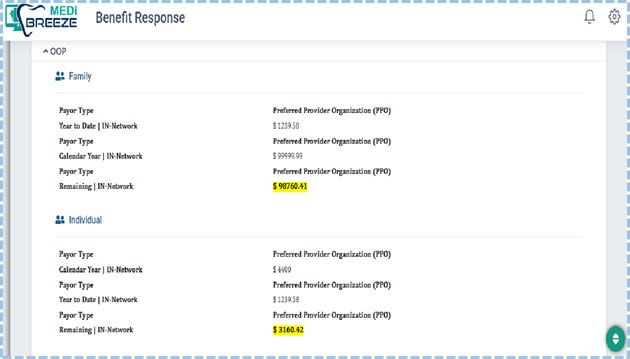

Out-of-Pocket Expenses (Family & Individual)

In order to find the correct out-of-pocket costs for both families and individuals (met and remaining) - (IN-Network and Out-of-Network), the front office needs to check the below screen.

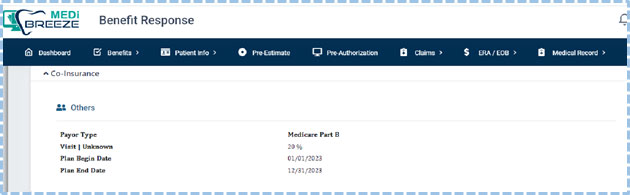

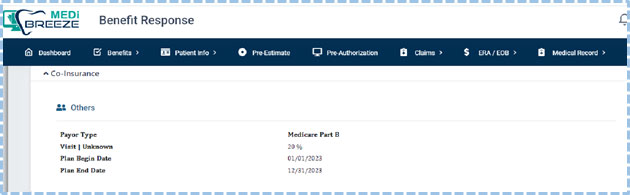

Co-Insurances (PCP & Specialist)

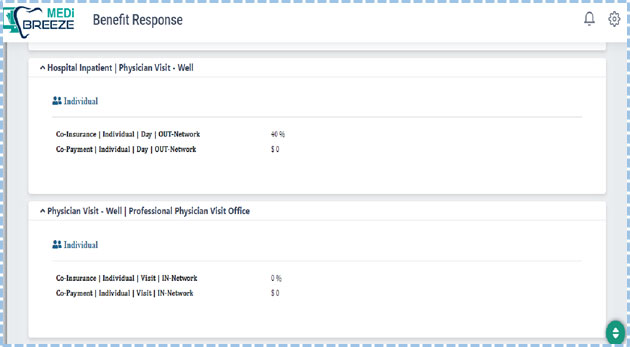

To discover the correct Co-Insurances information, the front office should look at the screen below.

Co-Insurances (PCP & Specialist)

To discover the correct Co-Insurances information, the front office should look at the screen below.

Co-Pays (PCP & Specialist)

Below is the screen the front office needs to check for correct Co-Pays (IN-Network and Out-of-Network) - PCPs and Specialists.